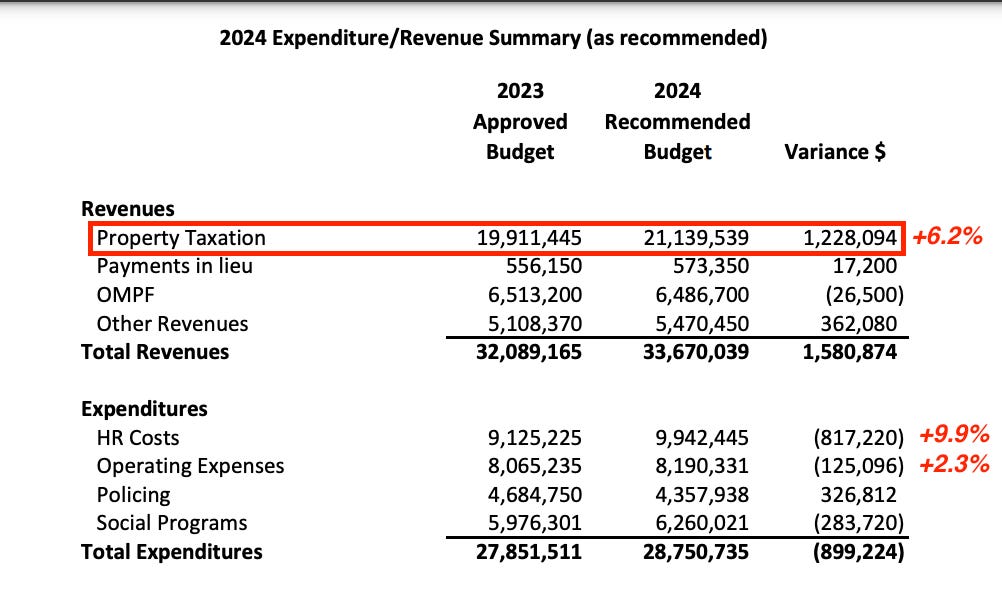

Taxes UP 4.67%. Revenues UP 6.2%

Council approves 2024 budget and tax increases.

This week, council approved the 2024 municipal operating budget which will see the tax levy increase 4.67%.

The proposed tax increase by staff in November was 5.3% but council found some wiggle room. Namely, council decided to decrease the Au Chateau transfer amount to 2023 levels to get the tax increase to a more palpable sub-5% level.

Since being elected this council has now passed two budgets with similar increases combining for a cumulative 10% increase to tax bills.

Although taxes are up 4.67%, the municipality is actually seeing an increase to tax revenues of 6.2% due to adjusted property valuations and new builds.

The city will be taking in $21.1 million in tax revenue in 2024 compared to $19.9M in 2023.

Just four years ago, the municipality operated on just $17.7M.

Considering there has been no new services offered or facilities built in the region and the population has remained stable, it is difficult to see the need for a such drastic increases in revenues.

The West Nip Voice is a regular newsletter covering issues in West Nipissing and the surrounding area. Please consider becoming a subscriber.

As I pointed out before, the biggest driver of West Nipissing’s balloning budget is HR expenditures which are jumping 9.9% this year after having risen 8% last year. In just two years, this council has now approved $1.5M in additional HR expenses ($8.4M to $9.9M).

There are no major projects planned this year and there is no indication that council or staff want to balance the budget to avoid large increases year-after-year. In December, councillor Daniel Gagne told council that 5% annual increases was no big deal insinuating that he would be comfortable aiming for this levy on a regular basis.

Lowest Taxed Municipality to Highest?

In 2018, West Nipissing residents may have been cursed to win the MoneySence award for having one of the lowest property taxes in the country. At the time the average homeowner paid $1,494.

This curse gave staff the justification to skyrocket our levies for the ensuing five years which resulted in the average bill jumping to $2,110 this year. At the current rate of 5% per year, the average West Nipissing taxpayer will see their bill jump 72% in just 10 years after winning the prestigious award. Unfortunately 2018 was the last year that MoneySense conducted this survey. If they redid the survey today, West Nipissing would likely fall to nearly 100th place (White Rock, BC was 99th place in 2018 with an average tax bill of $1,958).

2018 Average Tax Bill = $1,494

2024 Average Tax Bill = $2,110 (+41%)

2028 Average Tax Bill (forecasted) = $2,573 (+72%)

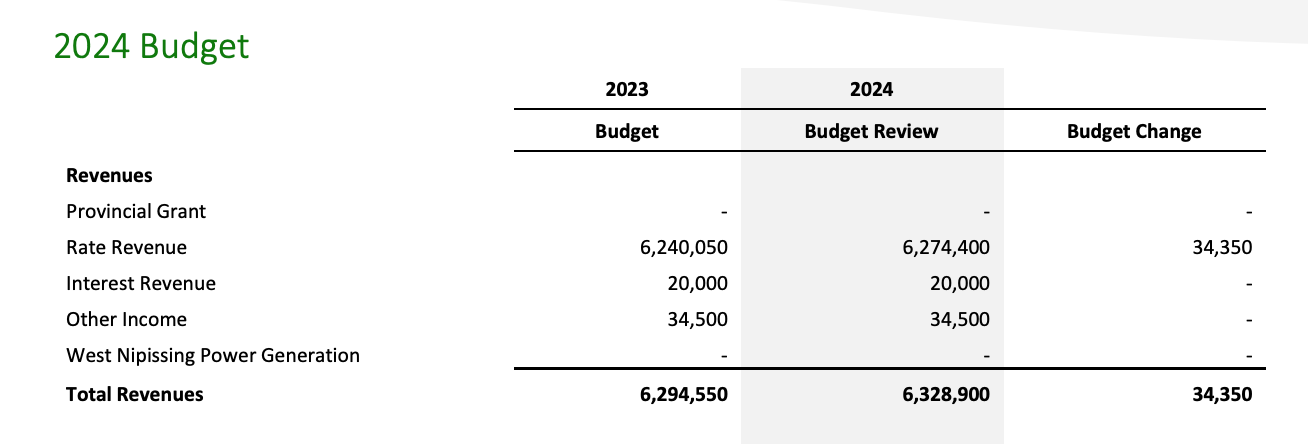

Water & Sewer

On Tuesday night, council also approved the 2024 Water and Sewer budget. As opposed to city hall, the water and sewer department seems to know how to balance it’s budget.

Water and Sewer rates will only rise 2.7% in 2024 which will result in a $41 increase to the average annual bill. Between 2022 and 2024, the water and sewer rate revenues have only risen a cumulative 3% (from $6.1M to $6.3M)

The West Nip Voice is a regular newsletter covering issues in West Nipissing and the surrounding area. Please consider becoming a subscriber.

Adding both this to the situation at Au Chateau, makes one look to the next municipal elections. Only this time a FULL SLATE of reformers would be in order.

Good work in any case. Thanks

Thank you Réjean. You always make everything very clear for us and we appreciate you.