West Nipissing To Finalize a 5% Tax Increase

This will represent an average increase of approximately $91 per household.

WN Council needs to have hard conversations about its finances before we see the same unsustainable increases next year. And the year after.

At the upcoming council meeting, council will vote to ratify the proposed budget for our municipality.

As I described last month, our municipal finances are in trouble regardless of what the final tax increase we settle on. The original proposal from the administration was to increase taxes by 6.75%. After numerous meetings with very little debate or pushback, the CAO has proposed a final increase of 4.75%. So what has changed?

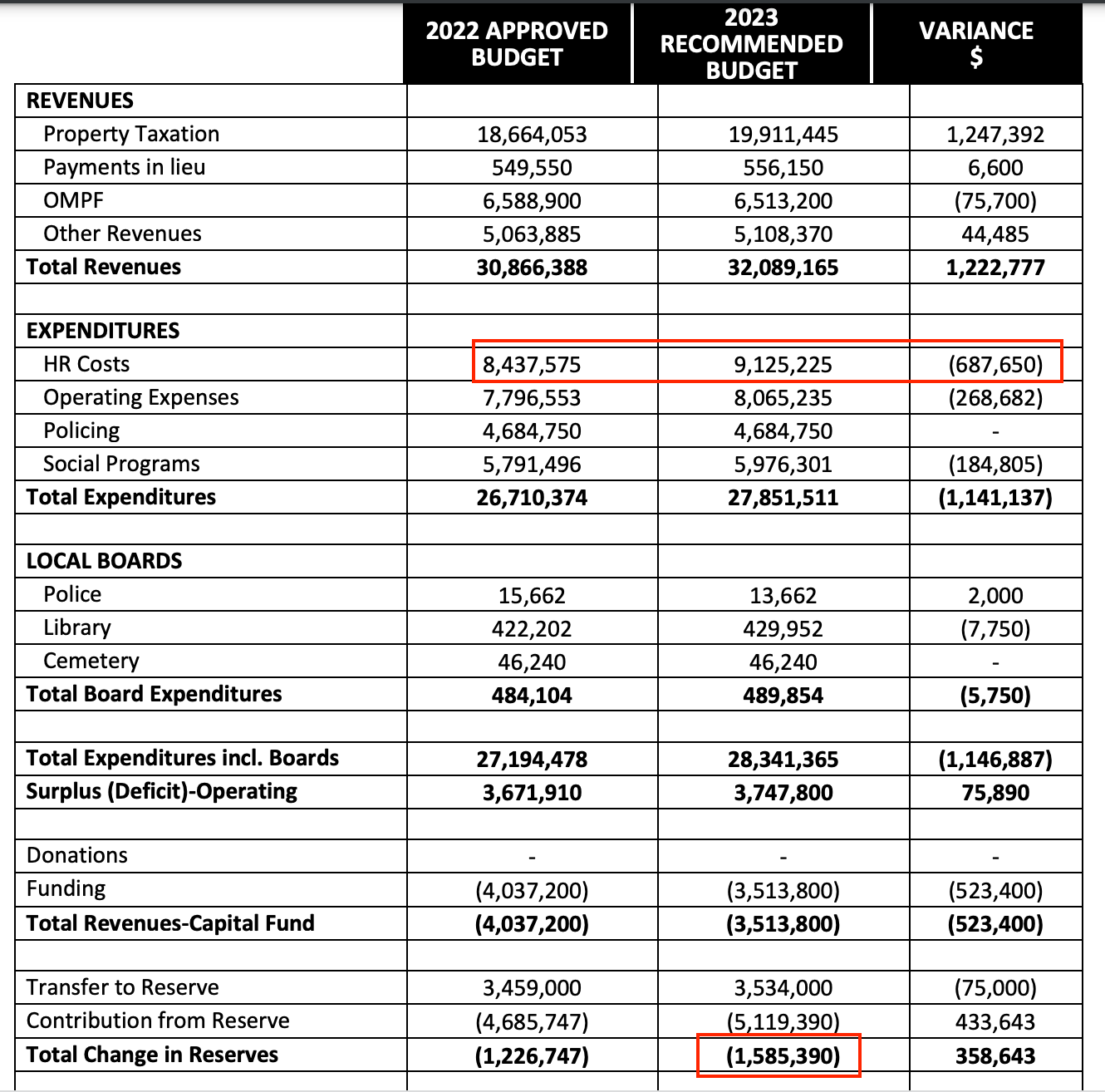

If you recall, in order to squeeze in a 1% tax increase during an election year in 2022, the city had to dip into it’s reserve for $1.5M. This was described as a large amount by the CAO as it is not a reliable source of operating revenue. It was understood that this year, the municipality should reduce its dependency on this reserve because by next year, they may have to operate a budget with no reserve whatsoever.

The original proposal had the municipality dipping another $1.2M in the emergency reserve fund. Well I guess all memos of fiscal responsibility were put into the shredder last month, because now they are forecasting to go even further than the previous council and take $1.6M from reserves.

What does this mean? With this much reliance of reserves this year, it means, the municipality will likely not be able to touch any more reserves next year. So watch out for 2024 when this process will start with a $1.6M shortfall (or the equivalent of a 6.3% increase before any other increases to operations or HR).

So that’s why this budget worries made. Although we are being told that 4.75% is better than 6.75%, it’s what’s below the surface that scares me. By accepting this budget with no hard conversations or any cutbacks, we are accepting a almost guaranteed 10%+ increase next year.

5 Year Average

With this proposed increase, this is what our overall tax hike has been for the last 5 years.

2019: 5.74%

2020: 6.2%

2021: 2%

2022: 1%

2023: 4.75%

Cumulative Tax Increase 2019-2023 = 21%.

We were once known as a low taxed municipality. But we are quickly becoming known as having the fastest rising tax rate.

Biggest Expense

As is the case with most municipal budgets, our biggest expenses is human resources. This is understandable. But the drastic increase on this line isn’t. While I cannot identify a single service that has been added or improved in the last 4 years, the HR costs for our municipality will go up 8% this year (from $8.4M to $9.1M). Some of this can be explained by the fact that the number of municipal employees locally on the Ontario Sunshine list has ballooned this year. Our municipality had 17 names on this year’s list compared to just 13 the year pior.*

*I’ll follow up with a closer analysis of this list and how it compares to the average WN resident’s salary later this week. Subscribe so you don’t miss out.

Subscribed

Flawed and Deceiving Math to Trick the Taxpayers

In order to sell this still higher-than-average increase, the CAO used some very creative but unethical trickery. Last week he stated that this proposed increase will work out to an average increase of just $53 for approximately 65% of households (those houses appraised at under $100,000).

Every statitistian or expert in a math related field will agree that this is not a fair way to present this increase. The municipality is not claiming that the average tax bill will only go up by $53. They are not even claiming that 65% of people will see a rise of $53 or less. They just chose an arbitrary percentage of the population and took whatever average of that specific group and found a way to deceive us into thinking this only results in a minor increase. Even most people in the 65% group will pay more than $53 more per year. *

*This would be no different than saying that 20% of the population will only see an average increase of $10. It’s not incorrect. But it does not tell us anything meaningful.

The reality is that the average taxpayer will see an increase of approximately $91 (based on a average tax bill of $1,925 in 2022). For the first time ever, the average tax bill will now be over $2,000 and anyone with a property assessed at $300,000 or more will pay over $3,500 per year in taxes (an increase of over $150).

Again, they did not lie when presenting this statistic but it’s just not the way that tax increases should be presented to the public. The average homeowner will not simply see an increase of just $53. If they want to present it this way then they need to say: The Average Increase Will Be $53 (if 35% of the taxpayers disappear and don’t pay their taxes anymore).

Our municipality cannot continue on this trajectory. We have seen no major projects, no major updates, no major added services. All we have seen is a ballooned sunshine list and steady tax increases that average double the rate of inflation long-term. This council needs to start having hard conversation about our municipal finances. Otherwise we will be in the same boat again this time next year.

The West Nip Voice is a regular newsletter covering issues in West Nipissing and the surrounding area. Please consider becoming a subscriber.