Proposed 6.52% tax increase for 2025

Budget deliberations started yesterday.

Summary:

In an effort to finalize the 2025 budget early, council is holding their deliberations this week. The first meeting was last night where council heard from staff that the proposed property tax increase is 6.52%.

This is because they are predicting a shortfall of $1,377,484 and each 1% of tax increase represents $211,395.

Staff did acknowledge that the city will benefit from a huge increase from the Ontario government’s subsidy to the municipality. Last month the province announced that rural and northern municipalities would see an increase in their Ontario Municipal Partnership Funding (OMPF). West Nipissing’s portion of the OMPF will jump $679,000.

Along with the sale of a few municipal properties this year, this boost doesn’t seem to be enough to cover the requirements of the municipality.

Once again the largest contributor is human resource costs. The municipality is requesting an increase of 8.8% to their HR costs. This is after a 10% increase last year and combined 51% increase since 2020.*

*In 2020, HR costs ($7.2M) represented 40% of the property taxation budget. In 2025 HR costs ($10.8M) will represent 50% of the property taxation budget.

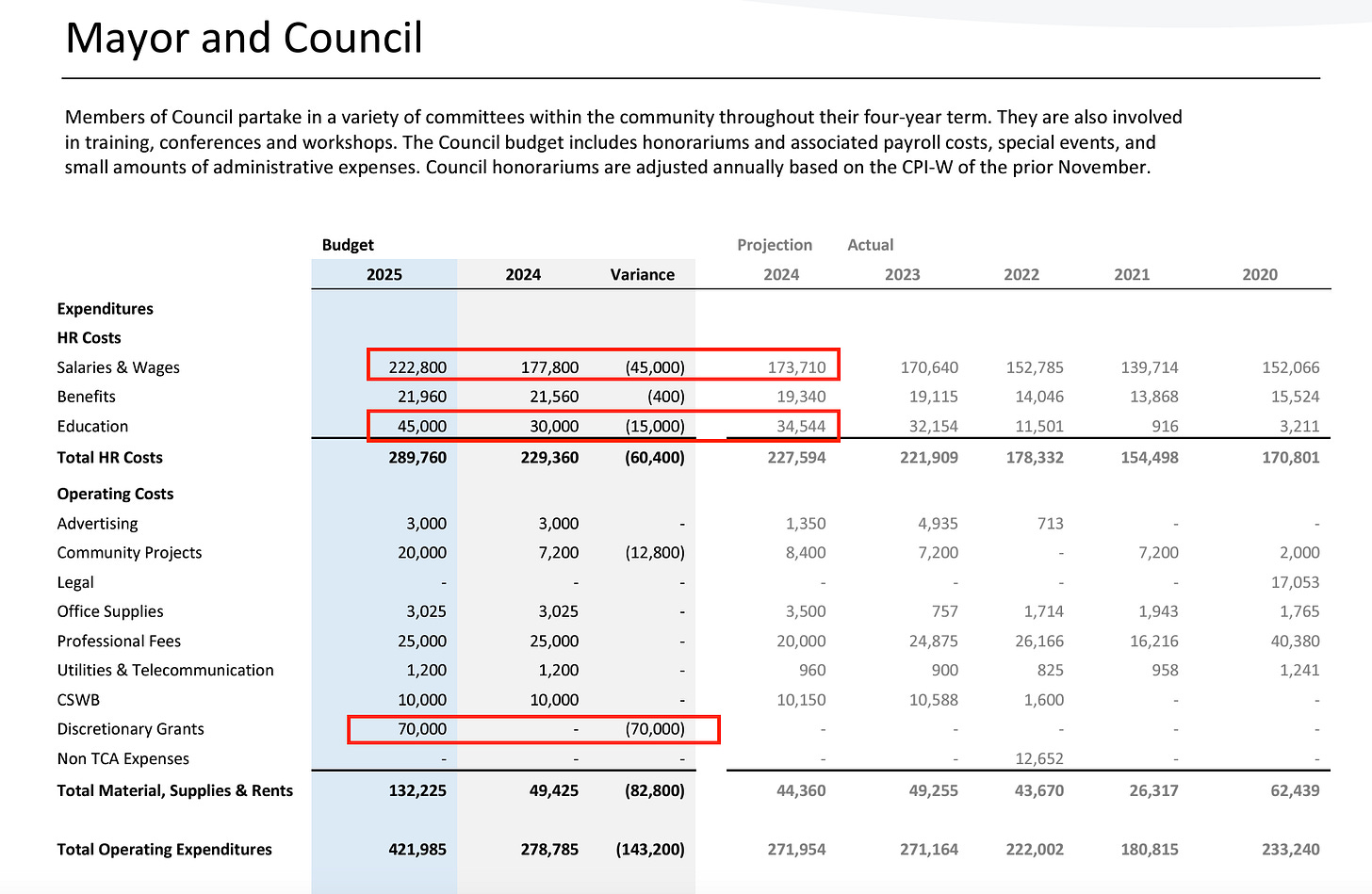

Digging deeper, the “Mayor & Council” budget is set to increase by $143,000 or 50%. This is due to a projected increase in council salaries from $173,710 in 2024 to $222,800 in 2025 (a 28% increase). Council has ordered a review of their salaries and those findings are going to be delivered soon.

Council’s “education” budget which is used to attend various out-of-town conferences is also going up $15,000 (or 50%) and a new “Discretionary Grant” line of $70,000 is being added.

With several new bylaws adopted in the last year, the bylaw enforcement budget is slated to go up. $174,445 is allocated to the department in 2025. A 50% increase from the $116,550 budgeted for in 2024 and up nearly 300% from 2023 when the department spent $61,154.

The Fire Department’s budget is also seeing an increase of $211,000.

As stated by the CAO in the budget presentation, many costs are outside the municipality’s control. Such as policing costs which are set to increase 6.8% in 2025 and represent at least 1% of this year’s tax increase.

The District of Nipissing Social Services Administrative Board (DNSSAB) is raising their levy by 4.25% or $153,000 and Au Chateau is requested a 6% increase of $69,000.

The Economic Development department is seeing an increase of 70% largely driven by a request to increase the “doctor recruitment” budget from $20,000 to $120,000 in 2025.

Other contributors to the overall increase is an estimated $45,670 increase in insurance costs for the municipality and a $78,570 increase to their utility costs (largely driven by hydro costs).

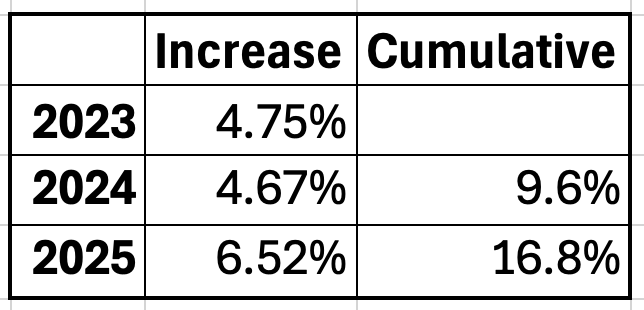

Cumulative 16.8% increase since 2023

Last year’s budget deliberations started with a proposed increase of 5.3%. With very few adjustments including a dismissal of pickleball courts and a reduction in Au Chateau’s budget, council ended up settling on an increase of 4.67%. In its first budget, this council approved a 4.75% increase in 2023. If accepted, the proposed increase in 2025 would mean West Nipissing taxpayers will see a cumulative 16.8% increase in just three years.

The West Nip Voice is a regular newsletter covering issues in West Nipissing and the surrounding area. Please consider becoming a subscriber.

Your council is way overpaid. Unless they spend a lot more time on municipal business than most councils. All other municipalities are bloated with HR without any justification. Bylaw enforcement shouldn’t be rising because bylaws are only applicable to municipal property and nit enforceable on private land.

Checkout the Ontario Landowners Association. It is amazing what councils and staff thin they know and can do but they can’t.

way too much for council. most residents make three times less than that with two working adults.